Who Benefits from “Medicare Decoded”?

· Helping “Baby Boomers” and their Parents “The Great Generation,” Saving Thousands

· “Millennials” solidifying their Inheritances, by understanding how their “Baby Boomer” Parents’ are Protecting their “Nest Eggs”

· Helping Employers Save Millions

· Sharing with the Medical Insurance Companies, the Health Industry, and the Government how they can Save Billions

· Educating CPA’s, Attorney’s, “Financial Planning” Advisors, Group Health Insurance Brokers, and Individual Medical Insurance Agents, with their Client’s Short & Long Term Fiduciary 21st Century Goals

"Our Society and the marketplace do not have a Healthcare Cost Crisis. We do not even have a Healthcare Crisis. We have a Health Crisis. As soon as we all understand this, and the real issues, then, and only then, will we be able to create solutions, and achieve profound financial strides, as we navigate through the 21st century."

Rick Solofsky

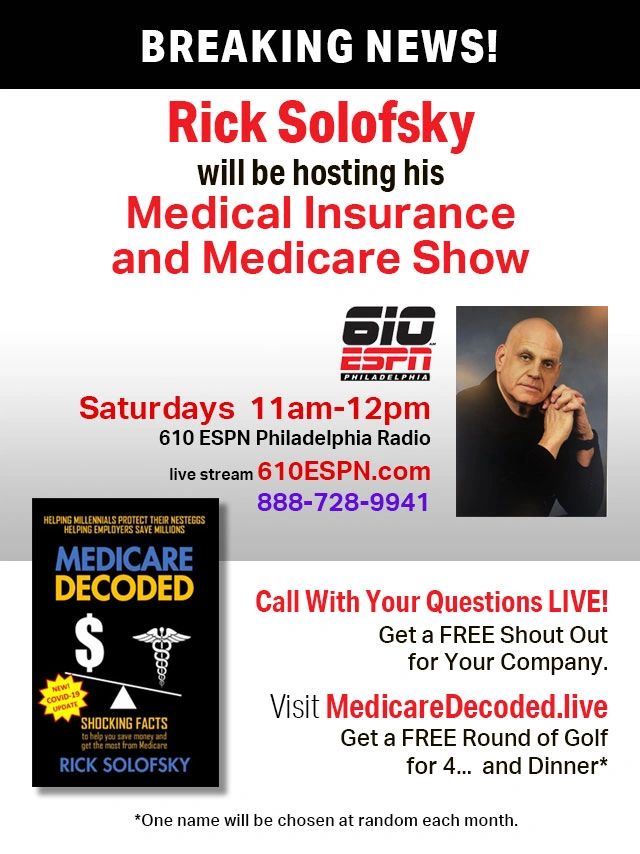

Rick Solofsky, a 1979 graduate of West Chester University, has over 30 years of experience as a health a health-care broker and a high level consultant with a specialty in Medicare and the interpretation of "Medicare Secondary Payer Law" and how it applies to the group insurance culture. Today, Solofsky Financial Group administers over 500 group health-care accounts in Pennsylvania and New Jersey, in addition to over 700 individuals, and Medicare Supplement policies for more than 400 individuals. Rick frequently educates other brokers, CPA's, and attorneys about changes in the Medicare/Health-insurance landscape. A regular contributor to many financial talk shows, Rick credits his dual major-Health/Physical Education and Psychology- with helping him better understand the "Big Picture" of the role of health insurance in American Life.

Get in touch---Rick is here to help!

Phone/Text: 215-432-7425

Email: rick @solofskyfg.com

MEDICARE DECODED IS AVAILABLE ON AMAZON

Medicare Decoded: Shocking Facts to Help You Save Money and Get the Most From Medicare Paperback – February 25, 2020

by Rick Solofsky (Author)5.0 out of 5 stars 4 ratings See all 2 formats and editions

Medicare coverage information

Section 105

Breaking News! IRS Section 105 Employers Allowed to Reimburse Employees for Medicare Premiums! (docx)

DownloadReimbursement for Medicare Premiums Through Employer Overview (docx)

DownloadWhat Medicare Premium Costs can be Reimbursed by the Employer under IRS Code Section 105 (docx)

DownloadIRS Code Section 105 Language (docx)

DownloadSection 111

Section 111 CMS Mandatory Medicare Secondary Payer Reporting (docx)

DownloadReviews

Subscribe

Contact us

Personalized coverage for you and yours

Please send us a message if you have any questions.

4030 Church Road Easton, PA 18045

(Lehigh Valley, New York, and Florida)

(office) 610-438-6488

(fax) 610-438-6489

(cell) 215-432-7425

rick@solofskyfg.com

www.solofskyfg.com

Medicare Decoded

Hours

Monday - Friday: 9am - 5pm

Saturday - Sunday: Closed